=

Alchemy is Now Business Warrior

Business Warrior and Alchemy are now one entity with more services and tech than ever! We've learned

from over 60 lenders worldwide what it takes from a lending platform to drive real results. We offer comprehensive end-to-end solutions ranging from acquiring borrowers to loan processing and payments,

all lining up to ensure maximum profitability for lenders.

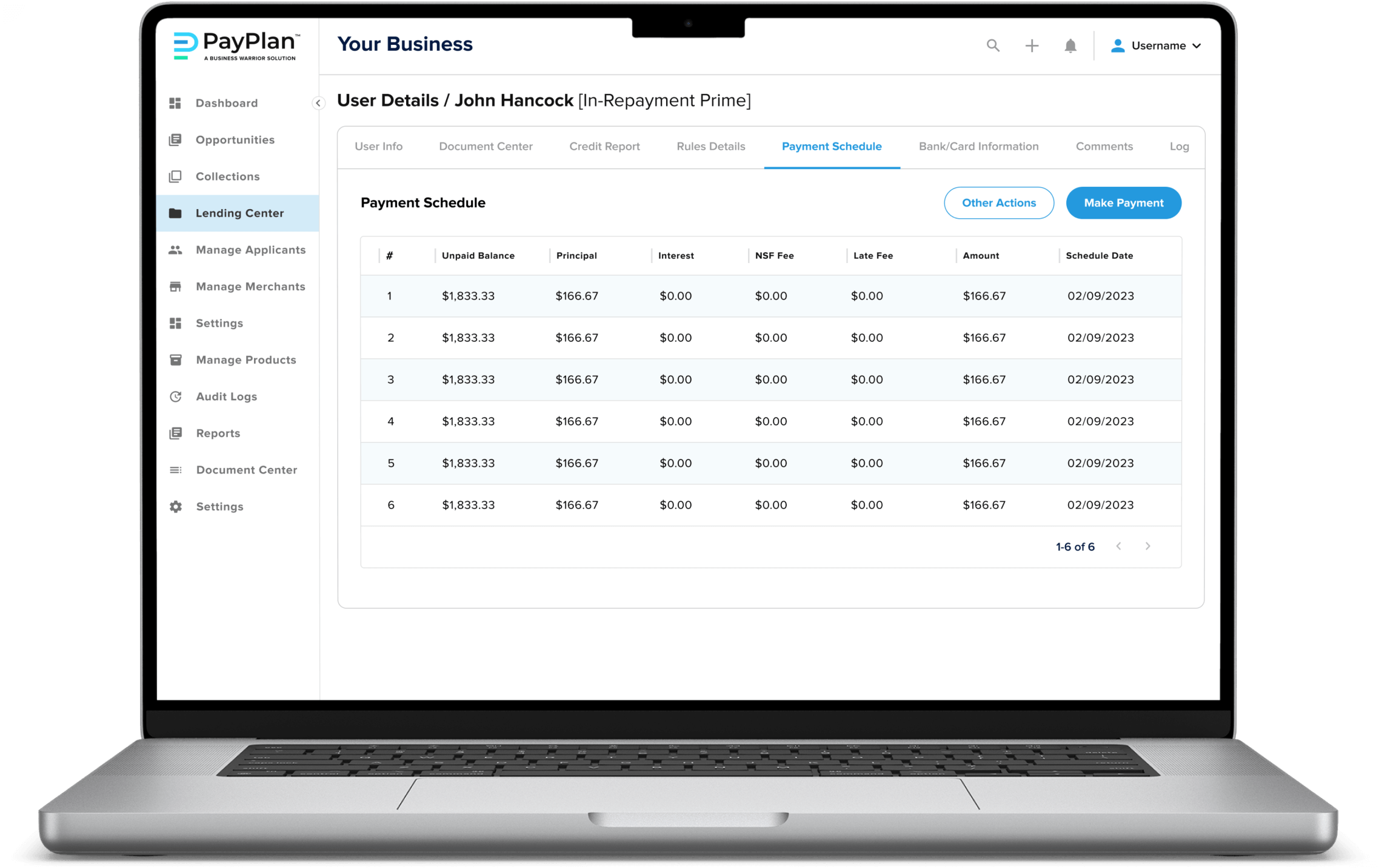

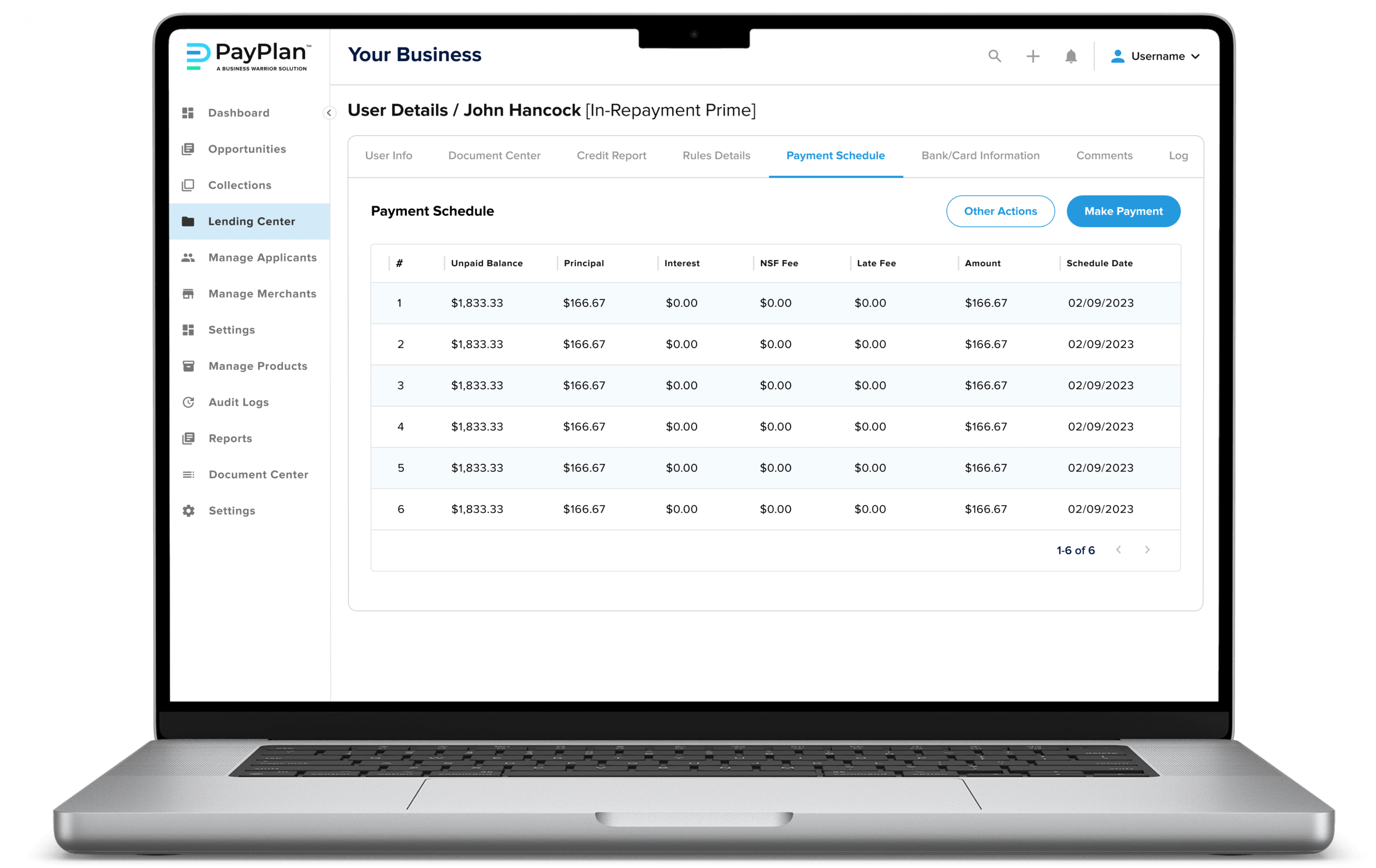

PayPlan is our flagship lending platform built for one purpose—to make lenders more profitable. It’s a completely transformative solution designed to simplify and streamline the application, decisioning and management experience for customers.

Loan Origination

Decision Engine

Loan Management

Marketing Services

Custom Lending Software Development

With decades of experience in fintech, lending, and software development, the combined Business Warrior and Alchemy team is the best development partner on the planet for enterprise lenders looking to build custom software solutions. To kick off your custom development project, please click the button below.

Years Combined Fintech Experience

Custom Platform Builds

In Loans

Supported Loan Types

.svg)

.svg)

.svg)

.svg)